Lifetime Financial Planners provides clear and actionable financial plans tailored to your specific needs and goals while leading with an empathetic , client-first approach to help optimize your financial life.

Behavioral Coaching to Navigate Emotional Life Events

- Death of Spouse

- Divorce

- Job Loss, Job Change, Corporate Reorganizations

- Life altering personal injury or medical illness

- Caring for elderly family members

- Blended Family Dynamics & Legacy Considerations

- Annual Exclusion Gifts to family members

- Inheritances

- Marriage

- Birth/Adoption of Child

Financial & Retirement Planning

- Financial Projections

- Evaluate Probability of Financial Plan Success

- Evaluate and Analyze “What If” Scenarios

- Social Security Claiming Strategy

- Defined Benefit Plans, Military Pensions, & Annuities including Survivor Benefits

- Required Minimum Distributions (RMDs) from Traditional IRAs, and Inherited Traditional & Roth IRAs

- Spending Strategies & Withdrawal Order

- Retirement “Paycheck” & Cash Flow Projections

- College Planning / Student Loan Considerations

Investment Management

- Identify Risk Tolerance to construct appropriate investment portfolios

- Design and create customized Investment Policy Statement (IPS)

- Implement cost-effective, tax efficient, broadly diversified investments

- Monitor external investment accounts including Employer Retirement Plans

- Analyze real estate holdings including Rental Properties, Vacation Rentals, Farmland/Ranchland, and include within overall asset allocation strategy

- Rebalancing periodically

- Asset Allocation

- Asset Location

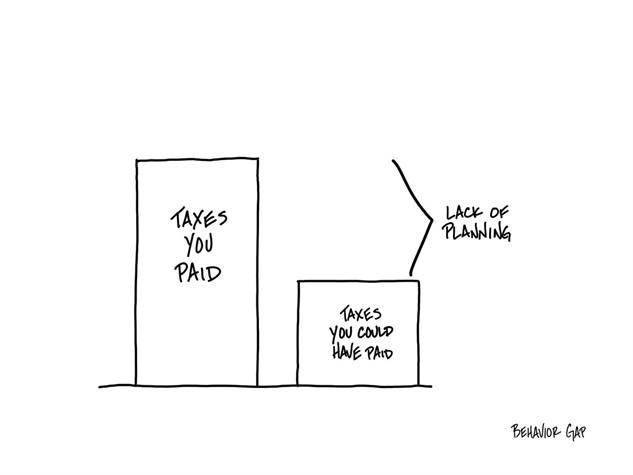

Income Tax Planning

- Annual Tax Return Review & Year-End Tax Planning

- Multi-Year Tax Projection Scenarios

- Executive Compensation Plans

- Donor Advised Funds (DAFs)

- Qualified Charitable Distributions (QCDs)

- Tax Loss/Capital Gain “Harvesting”

- Medicare Income-Related Monthly Adjustment Amount (IRMAA) Surcharge

- Roth Conversions

Insurance & Risk Management Planning

- Life Insurance Needs Analysis

- Disability Insurance Needs Analysis

- Long Term Care Insurance Needs Analysis

- Health Insurance Review & Coordination

- Health Savings Accounts (HSAs)

- Homeowner’s Insurance Review

- Auto Insurance Review

- Liability Coverage Limit Review

- Liquidity Considerations

Estate Planning

- Review existing Estate Plan including Wills & Trusts

- Review Account Titling & Beneficiary Designations

- Guardians for Minor Children

- Durable Power of Attorney (DPOA)

- Medical Power of Attorney (MPOA)

- Directive to Physicians / Healthcare Directive

- Incapacity Planning Considerations

- Tax Efficient Charitable Giving Strategies